Computer rate of depreciation

1 12 times the. Hence the depreciation expense for 2018 was 8500-500 15 1200.

Ay 2022 23 Depreciation Rate Chart As Per Income Tax Act 1961 Income Tax Taxact Income

Not Book Value Scrap value Depreciation rate.

. Under the depreciation formula this converts to a Diminishing Value percentage rate of 50 per annum or Prime Cost 25. Applicable from the Assessment year 2004-05. Calculate depreciation for a business asset using either the diminishing value DV or straight line SL method.

What is a sensible depreciation rate for laptops and computers. If a company uses Written Down Value WDV method of depreciation it will need to calculate a new rate for depreciation to depreciate the asset over their remaining useful life. Yes if you own a computer you should be awareof thedepreciationrate on Computer Accessories and PeripheralsSo if you are using it for business than while.

Office Equipment - Computer Accessories Depreciation Rate. 170 rows Rate of depreciation shall be 40 if conditions of Rule 52 are satisfied. Total deduction for fixed rate method.

157 rows Cumulative depreciation for tax purposes is Rs 90 and the tax rate is 25. A good and oft-used rate is 25. Alternatively you can depreciate the acquisition cost over a 5-year recovery period in the year you place the computer in service if you dont elect to expense any of the cost under section 179.

This could be on a straight-line basis which writes the asset off at 25 of. That means while calculating taxable business income assessee can claim deduction of. All these components attract a depreciation rate of.

Hotels and boarding houses. Office equipment computers laptop notebook gateway compaq dell pc computer drive cd rom desktop. Depreciation rate finder and calculator.

153 rows Computer room air conditioning CRAC units including direct expansion DX systems 10 years. Residential buildings except hotels and boarding houses. Computer hardware software routers bridges and data acquisition systems are under the sub-head of Electric Equipment.

Using the shortcut method for the period 2 March to 30 June 2020 Colin works out his claim for additional running. 13728 19889 33617. Purely temporary erections such as.

The special depreciation allowance is 100 for qualified property acquired and placed in service. 2500 per year Keywords. Computer room air handling.

MobilePortable Computers including laptops and. Office Equipment - Computers Depreciation Rate. Where NBV is costs less accumulated depreciation.

Therefore the tax base opening balance as per IT Act is Cost of Rs 150 less. The rate of depreciation on computers and computer software is 40. View the calculation of any gain or loss.

The accounting for intangible assets and goodwill is a little tricky as it relates to acquisitions and its treatment for depreciation amortization is different than for fixed assets.

Declining Balance Depreciation Calculator Double Entry Bookkeeping Calculator Bookkeeping Accounting And Finance

How To Prepare Your Old Computer For Safe Disposal E Waste Recycling Old Computers Green Environment

Ebitda Vs Net Income Infographics Here Are The Top 4 Differences Between Net Income Vs Ebitda Net Income Learn Accounting Accounting And Finance

5 Logical Reasons To Buy A Used Car Visual Ly Buy Used Cars Used Car Lots Used Cars

4 Ways To Calculate Depreciation On Fixed Assets Wikihow Fixed Asset Asset Calculator

Best Gaming Monitors Under 500 1000 1500 2000 In 2022 Ecran Pc Gamer Pc Msi Ecran Pc

Depreciation In Income Tax Accounting Taxation Income Tax Income Energy Saving Devices

Customer Acquisition Cost Calculator Plan Projections Financial Modeling Accounting And Finance How To Plan

Switches Routers Printer Server Etc Cannot Be Used Without Computer So They Form Part Of Peripherals Of The Computer A Router Switches Application Android

Declining Balance Depreciation Schedule Calculator Double Entry Bookkeeping Bookkeeping Templates Accounting Basics Learn Accounting

How To Calculate Book Value 13 Steps With Pictures Wikihow Economics Lessons Book Value Books

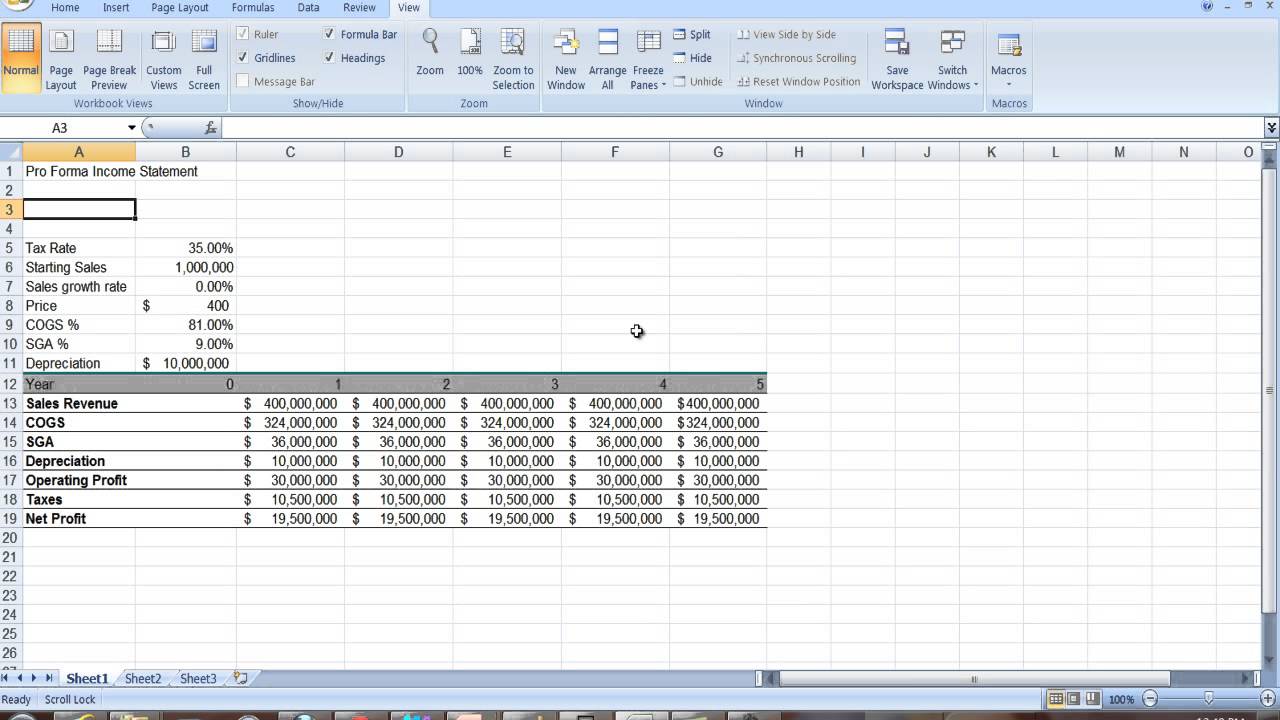

Download Projected Income Statement Excel Template Exceldatapro Statement Template Excel Templates Income Statement

How To Easily Calculate Straight Line Depreciation In Excel Exceldatapro Straight Lines Excel Line

Youtube Income Statement Profit And Loss Statement Income

Methods Of Depreciation Learn Accounting Method Accounting And Finance

Depreciation In Excel Excel Tutorials Microsoft Excel Tutorial Excel Shortcuts

Small Business Income Statement Template Unique 27 Free In E Statement Examples Templates Single Income Statement Statement Template Business Template